Understanding North Carolina Car Accident Laws: A Comprehensive Guide

Navigating the aftermath of a car accident in North Carolina can be overwhelming, especially when dealing with injuries, property damage, and insurance claims. Having knowledge of North Carolina car accident laws is crucial for protecting your rights and ensuring you receive fair compensation. Whether you are a resident of Greensboro or elsewhere in the state, understanding these laws can make a significant difference in how your case unfolds. Below, we will break down key aspects of North Carolina car accident laws, including what to do immediately after an accident, determining fault, handling repairs, and more. At Roane Law, our experienced attorneys are here to help you through this challenging time.

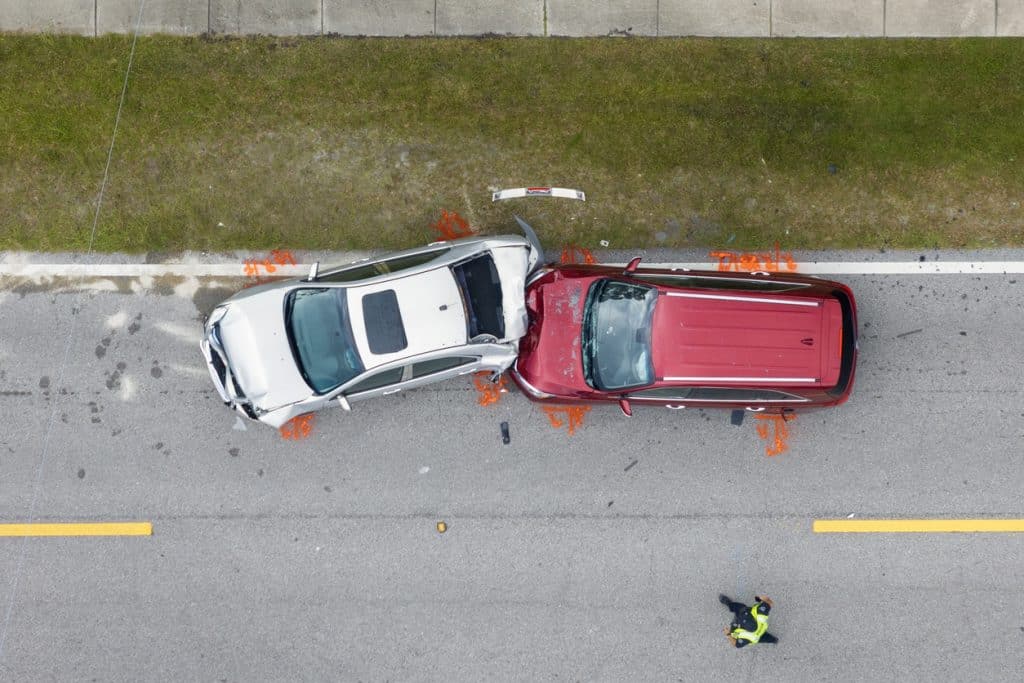

Immediate Steps After a Car Accident in North Carolina

Under North Carolina car accident laws, drivers have specific duties following a collision. The first priority is safety. Stop your vehicle in a safe place and, if possible, move it to avoid blocking traffic or causing further damage. If the accident involves injuries, death, or significant property damage, you must call the police. North Carolina law requires drivers to remain at the scene until law enforcement arrives or authorizes departure, especially in cases of injury or serious bodily harm.

According to North Carolina General Statute 20-166, known as the hit-and-run law, failing to stop after an accident that results in injury or death can lead to felony charges. Drivers must provide their name, address, driver’s license number, and vehicle registration to involved parties or law enforcement. If the accident only involves property damage, you still need to stop, exchange information, and report if necessary. For unattended vehicles or fixed objects like guardrails, leave a note with your details or report to authorities within specified time frames.

Gather essential information at the scene: the other driver’s name, address, phone number, license plate, driver’s license, and insurance details. Note the insurance company and policy number exactly as shown. Collect witness names and contact information, and document the scene with photos if safe to do so. Avoid admitting fault or agreeing to settle informally, as hidden damages or injuries may surface later.

Reporting the Accident and Filing a Claim

North Carolina car accident laws mandate reporting crashes to the police if they involve injury, death, or property damage exceeding $1,000. Once reported, contact your insurance company promptly. If another party is at fault, notify their insurer as well. Your assigned adjuster will guide you on next steps, but consulting an attorney early can prevent missteps.

For detailed guidance on handling insurance after an accident, refer to the North Carolina Department of Insurance’s resources on post-accident procedures. This includes checklists for what to do and how to proceed with claims. Remember, do not sign any releases without review, as they might waive your rights to further compensation.

Determining Fault Under North Carolina Car Accident Laws

North Carolina follows a strict contributory negligence rule, which is a key element of its car accident laws. If you are found even partially at fault, even just 1 percent, you may be barred from recovering any damages. Insurance adjusters investigate to determine negligence, reviewing evidence like police reports, witness statements, and scene photos. Disputes over fault often require court resolution.

This rule makes it essential to build a strong case proving the other party’s full responsibility. Factors like speeding, distracted driving, or failure to yield can influence fault determinations. In cases involving multiple vehicles or complex scenarios, expert reconstruction may be needed.

Handling Vehicle Repairs and Total Losses

If your car is repairable, North Carolina car accident laws allow you to choose your repair shop, though insurers may suggest one. The insurer covers repair costs, but they cannot mandate aftermarket parts unless equivalent in quality, fit, performance, and warranty to originals. Any modifications due to aftermarket parts must be included in estimates.

For disagreements on repair amounts as a first-party claimant, invoke your policy’s appraisal provision. You and the insurer each select an appraiser, who may involve an umpire for binding decisions. As a third-party claimant, you can file under your own coverage and let your insurer subrogate, or negotiate directly. Persistent disputes may lead to litigation.

If repairs exceed 75 percent of the vehicle’s pre-accident actual cash value, it is considered a total loss under North Carolina law. The insurer pays the actual cash value, based on local market value. Ensure valuations account for your car’s condition, mileage, and features.

Dealing with Injuries and Compensation

Injuries complicate car accident claims under North Carolina laws. Medical payments coverage, if included in your policy, can cover bills regardless of fault. Bodily injury claims may include medical expenses, lost wages, and pain and suffering. However, North Carolina has no set guidelines for calculating pain and suffering, so negotiations or legal action may be necessary if agreements cannot be reached.

The statute of limitations for personal injury claims is generally three years from the accident date. Prompt medical attention is vital, as some injuries like whiplash or concussions may not appear immediately. Document all treatments and impacts on your daily life to strengthen your claim.

Common Challenges and Resolutions

Insurance disputes are common in North Carolina car accident cases. If you disagree with collision or comprehensive coverage payouts, use the appraisal process outlined in your policy. Costs are shared, ensuring a fair resolution.

Other challenges include dealing with uninsured or underinsured drivers, drunk driving incidents, or accidents involving public transportation. Each requires specific approaches under state laws. For instance, hit-and-run victims may access their own uninsured motorist coverage.

To avoid pitfalls, consult a knowledgeable attorney familiar with North Carolina car accident laws. They can handle negotiations, gather evidence, and represent you in court if needed.

Why Legal Representation Matters in North Carolina Car Accidents

Given the complexities of contributory negligence and insurance tactics, having an experienced lawyer is invaluable. At Roane Law, we specialize in car accident cases, helping clients navigate these laws to secure deserved compensation. Whether facing denied claims or undervalued settlements, our team fights for your rights.

For personalized assistance, contact our Greensboro car accident lawyer today. We offer free consultations to evaluate your case and outline your options under North Carolina car accident laws.

About the Lawyer

James M. Roane III is the founder of Roane Law and brings a personal touch to car accident cases, having survived a serious wreck himself in 1995, which inspired him to pursue law at Wake Forest University. With over 22 years of experience, he has secured verdicts in every Piedmont county and won appeals in North Carolina’s higher courts, focusing on catastrophic injuries and fighting insurance companies. Learn more about his background and dedication on his profile page.